Introduction

This white paper discusses how open banking platforms like TrueLayer could expand their reach or coverage by addressing the 5 million people in the UK (Experian, 2022) who either have no or insufficient data for a reliable credit score. Based on these initial findings, this paper explores different solutions and benefits that would result from covering the invisible credit score owners for open bank providers and their retail clients.

Problem Statement

Experian (2022) reports that over 5 million of 53 million adult UK residents do not have a sufficient credit history and thus become partly or completely invisible to the financial system. An insufficiently supported credit score often locks people out of vital financial services such as credit cards, which are common payment solutions for eCommerce services. Therefore, people with invisible credit scores constitute a dormant customer segment, which could unlock new revenue streams for online retailers. Tucker (2022) explains in a blog post on TrueLayer how important coverage is in selecting an open bank provider. By addressing the needs of this dormant customer segment, TrueLayer could expand its coverage of end-users, and thus become more attractive to retail customers.

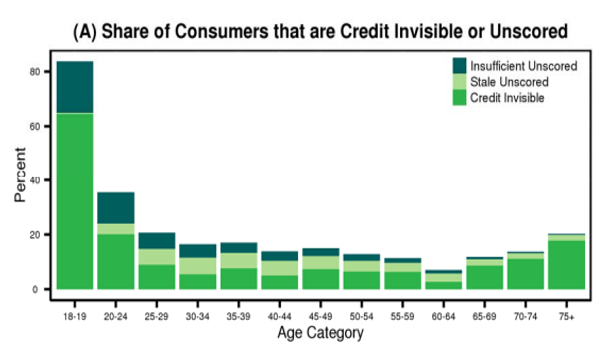

Financial unreliability does not have to be the main reason why people get insufficiently scored by credit rating agencies such as Experian, Equifax, and TransUnion (Gailey, 2022). People could have a stable job and be reliant on payments while still falling through credit scoring because traditional credit scoring does not take factors like rent, TV / phone bills, or deposit account information into account. A deeper analysis conducted by the CFPB Office of Research (2015), albeit a US governance agency, offers some insights into the reasons why people become credit score invisible that can be applied to the UK or European market. The main drivers were identified as age, income level, and immigration.

Gailey (2022) observes that credit scores rely significantly on the number of years where a person has used and demonstrated creditworthiness to scoring agencies. As consequence, young adults are more affected by an insufficiently backed credit score because they didn’t have the chance yet to build up a credit score. The proportion of people with invisible credit scores drops with older age with a surprising spike after retirement age. Reasons for the higher invisibility of credit scoring for senior citizens are expected to be a mix of a cohort effect, where credit histories were thinner in the 60s and 70s, and that deceased single earners were building up credit scores in lieu of their spouses (CFPB Office of Research, 2015).

Lower income is another determining factor for credit score invisibility, which is often caused due to a lack of access to traditional financial services. Consequentially, low-income earners often don’t qualify for financial tools like credit cards to build up a tracked credit score. These customers are therefore required to look for alternative financial tools that come with high-interest rates or that do not build up their credit history (Gailey, 2022).

Another source of invisible credit scoring is caused by immigration. Immigration can occur in many different forms such as student mobility or professionals who are hired by UK companies. Naturally, immigrants have a lack of credit history in the UK, which locks them out of many financial services, as these providers do not consider foreign credit histories. This challenge of building a credit score is recognized by credit scoring agencies who state that building up a credit score after moving to the UK is a chicken and egg challenge (Equifax, n.d.). Immigrants are often open to using local financial tools and organising themselves in local communities as a result.

All these reasons have in common that people are looking for better tools to organise their finances and thus would be potentially open to new technologies such as open banking.

Solution

Open banking could be an effective technology to combat credit score invisibility, which was recognized in an article by Experian in 2022. TrueLayer’s capabilities and experience would become valuable assets to assist in providing people with personal finance tools. In return, TrueLayer could access underserved customer groups who currently are either required to pursue other payment terms (e.g., sending cash for young people) for online shopping or need to enter unfavourable financing terms to access credit cards. This untapped market would increase the coverage and adoption of TrueLayer’s open bank platform.

TrueLayer is an ideal situation to cover these underserved customers with their open banking platform for several reasons:

- The international presence of TrueLayer provides a strong asset to address immigrants who have no local credit score, especially within Europe. The prospect that using TrueLayer’s open banking platform would facilitate mobility in the future would be very enticing for young people, European citizens, as well as people who want to keep the option open to move countries. Open banking could offer a way to avoid having to build up a credit score every time someone moves within Europe, which is particularly frustrating for people who have already demonstrated their creditworthiness. Europe would be a natural place for TrueLayer to start, which could eventually be expanded globally due to TrueLayer’s reach.

- Instead of using screen scraping technology to process banking execution, TrueLayer offers an open banking platform, which accesses only the relevant data through controlled connections to the bank’s systems (Tweddie, 2022). This adds security to the solution while also conforming with expected regulatory developments within the European market (Cazacu, 2022).

- TrueLayer has the expertise, experience, and partnerships to tailor their products to the needs of the end-users with invisible credit scores. The requirements would need to be refined in workshops such as design thinking sessions. For example, TrueLayer’s platform could be adjusted to facilitate credit building for teenagers with parents as guarantors. In collaboration with fintech companies like Revolut, TrueLayer could also offer products for low-income earners that build up a credit score.

- As a young and data-driven company, TrueLayer has the flexibility to experiment with different adoption models and the capability to measure the successes of these approaches. Currently, around 10% of people in the UK do not have proper access to personal financial tools and thus are underserved. In order to tap into this customer segment, experimentation and an ‘Own it’ attitude are required, which is a significant competitive advantage of TrueLayer compared to large, established financial institutions.

Considerations

People without a visible or sufficient credit score are often overlooked, although they could have a stable financial situation. Retailers that work with TrueLayer would thus profit from another customer base, which does not fall into the traditional credit scoring, and therefore lack the means to pay for online purchases. Before pursuing the approach of including people with invisible credit scoring, TrueLayer needs to understand the impact and potential of the growth. Besides the roughly 5 million UK residents, there are also secondary effects when building bridges to the financial systems. First, it’s a clear sign for diversity and inclusion (D&I), which is in line with TrueLayer’s core values of ‘Open up’. This engagement for D&I could be celebrated through various PR channels including media.

However, caution is advised while doing so. As noble the notion of including individuals with invisible credit scores sounds, it also requires the consideration that a significant proportion of individuals are actually not creditworthy and thus could use an open banking platform maliciously. It therefore becomes paramount for TrueLayer to ensure proper KYC processes and verification to maintain the trust people set in open banking and the technology behind it.

Customers with limited credit scoring could become a niche that few other financial market players serve, and thus provide opportunities for creating awareness of TrueLayer. If implemented carefully, this niche would increase TrueLayer’s platform adoption. Nonetheless, it is important to acknowledge that including non-scored people is a break from the traditional finance industry, which considers credit scoring as a reliable way to manage risks. It requires clear communication about why open banking works with limited credit scoring. Change management should accompany the rollout to ensure unexpected deviations and objections are properly addressed.

Conclusion

It is easier getting new users adopting a solution than convincing users of an existing solution to switch. People who don’t have a credit score to back up their creditworthiness are not necessarily bad customers or lenders; often they can’t access the tools to build up their credit score in the first place and do not have much recourse. This presents an opportunity for disruptive fintech companies such as TrueLayer to become a natural solution for these people, and thus give UK residents more means to participate in the financial market.

References

Cazacu, A. (2022, November 10). Instant payments are coming to Europe — so what? TrueLayer. https://truelayer.com/blog/instant-payments-are-coming-to-europe/

Equifax. (n.d.). Moving To The UK And Your Credit Score. Equifax. Retrieved December 14, 2022,from https://www.equifax.co.uk/resources/loans-and-credit/credit-score-when-you-move-to-the-uk.html

Experian. (2022, March 21). Meet the 5 million ‘credit invisible’ Brits still at risk of exclusion from the financial system. Experian. https://www.experianplc.com/ media/latest-news/2022/ meet-the-5-million-credit-invisible-brits-still-at-risk-of-exclusion-from-the-financial-system

Gailey, A. (2022, September 9). The U.S. Credit System Is Failing Millions of Americans. Here’s What You Can Do About It. NextAdvisor in Partnership with TIME. https://time.com/ nextadvisor/credit-cards/credit-system-fails-underprivileged-communities

The CFPB Office of Research. (2015). Data Point: Credit.Invisibles. Consumer Financial Protection Bureau.

Tucker, N. (2022, August 4). Financial services: what to look for in an open banking provider. TrueLayer. https://truelayer.com/blog/choosing-best-open-banking-provider-financial-services

Tweddie, A. (2022, October 26). What is screen scraping and how does it work? TrueLayer. https://truelayer.com/blog/what-is-screen-scraping/